Transition minerals and materials: Resilient value chains and circularity

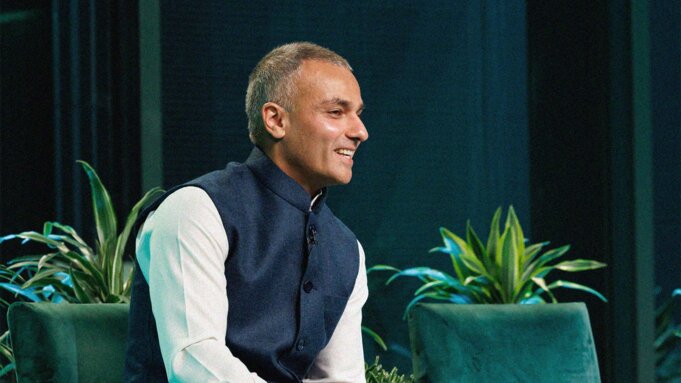

At Barclays' Sustainable and Transition Finance Conference, ICMM CEO and President Ro Dhawan argued the mining sector isn’t facing volatility but chaos – a deeper shift with major implications. In a conversation with Zornitsa Todorova, Head of Thematic FICC Research at Barclays, he highlighted the rising geopolitical interest in minerals, surging demand driven by electrification, and the urgent need to rebuild public trust in responsible mining.

(Ro’s remarks are verbatim, as spoken)

Q: So how would you characterise the challenges from a mining perspective? And can you apply some of the lessons that you've learned in the past to the current geopolitical landscape?

Ro: No, because everything we've learned in the past was how to cope with volatility. This is not a period of volatility. It's a period of chaos, and that's a better way to think about the world we live in than a period of volatility.

And so people sometimes ask us, you must be making a lot of money from your mining operations? No, because we don’t know what is going to happen tomorrow morning. The person in charge doesn't know what's going to happen tomorrow morning. How is anybody else going to anticipate that?

But there are three things happening in the industry that I believe make this the most interesting time in the most interesting sector in the world. And I want to convince you of that.

For the last two or three decades, we have essentially been saying to governments, "Please pay more attention to the mining industry, because without us, you can't have renewable energy, you can't have electric vehicles, you can't have IKEA stores. Why, are you not paying attention to us?’’

But suddenly we’re in the middle of somebody trying to buy another country for the metals and minerals that they have, we're in the middle of a situation where somebody is trying to strike a peace deal with another country because of the metals and minerals they have, or trade metals for security, or annex another country as your 51st state, right?

So, it’s great that we now have more government interest in mining, but it completely unlike anything we’ve seen before. But at least we have governments looking at mining differently and taking an interest.

The second thing is that we're living through a once in a generation of change in the mineral intensity of the global economy. What I mean by that is today, all of us collectively as nearly 8 billion people around the world, we consume an average of 10 tons of metals and minerals per person. Average. Many of us in this room, richer, consume more, and people in India consume a lot less, so in India it's about four tons.

In the future, if you take that average of 10, that's going to go up to 13 or 14 or 15. Why? Because we're shifting from an economic system run by energy molecules to one run by electricity, electrons. And the minute you do that you increase the amount of metal you need. Why? Because an electric vehicle takes four times as so much copper as a traditional car. Wind turbines take nine times as any metals as a gas power station. Great. And countries like India, are going to get richer, therefore, we're going to need a lot more metal and mineral to supply the world for the energy transition that we need.

In other words, this is the biggest purchase order in the history of mining - by far. And it's a secular trend that's going to carry us through at least the next two or three decades. I can't imagine a sector that has a more healthy, long-term demand for what it produces than the metal and mineral industry.

Great, so governments are more engaged. Our demand profiles looking great, and now it becomes really interesting.

Because of the third factor and I'm going to ask for your help to illustrate what it is. Please raise your hand if you would like a mine in your backyard. Okay, so, no hands. Maybe that's an unfair question. Please instead raise your hand if you think the mining industry generally operates responsibly. Still no hands, and that's my point.

We are faced with a situation where the world has never needed more of what mining produces, and yet, the trust in our ability to supply that responsibly has arguably never been lower.

How to square that equation is fascinating. There is absolutely a piece of the puzzle about helping people understand why metals and minerals are so important and hopefully we've done just that today, but I think most of the people in this room already knew that.

It's a whole different kettle of fish to demonstrate that we operate responsibly, and that a responsible mining and metal production is indeed possible. Because if we don't do that, we end up in an environment where at the very time you need 300 new mines – which is generally what we're talking about - it's the hardest it's ever been to open a new mine.

So, with governments much more engaged in the industry, with our demand profile looking really, really healthy, we still have a lot of work to do to win over the trust of society that we can do so responsibility.

I hope I've convinced you at least that this is the most interesting time in the most interesting sector.

Q: It has definitely convinced me. So what can the mining industry do to make sure that it gets going, because to your point, we are going to need the mining industry. So what can be done?

Ro: Many people here are either managers of capital, providers of capital or receivers of capital. The one thing we as an industry have not done, and let's just be honest about this, is we generate meaningful shareholder value for the last 10 or 15 years. And unless we change the way investors see us, we have no hope of getting the kind of capital we need to grow the industry

Now, if you combine the total market cap of every listed mining company in the world, you get to a number, let's call it two trillion dollars. And depending on which day you do it, that two trillion dollars is somewhere between a third and a half of the market cap of Tesla, or Alphabet. Companies that would not exist without us. So, it's an extraordinary situation where a combined market capitalisation of suppliers is less than half of a single company they supply to.

So, this is a major opportunity for us as an industry to achieve a re-rating of the sector, and for investors to get behind the sector at a time when it might just be ahead of a rerating. And this is partly why, whenever mining companies must decide on their capital framework, one of the things they do is they buy-back their own shares. Because they say the market doesn't recognise the deep value in our assets and in our company, so we're just going to buy it. So, we have an option now to rerate the sector once and for all, based on the energy transition narrative. That's one big option.

The second big ask of us is to attract a range of people and ideas into mining that we have never had the chance to do before. Because if you are the best biotechnologist or the best human scientist, or the best anthropologist, there is no more exciting industry, I would argue to work in than mining. It's hard for you to articulate your contribution to the world than helping the world transition to a more sustainable energy system.

So we have a narrative around the industry and a role for the industry that should allow us to bring in a set of talent and ideas that we have struggled to do for a very long time. So that's a major opportunity.

And the third thing I would say is, that it's a brilliant time to think about different ways of working than what we have done in the past. I'll give you one quick example. You can go to many parts of the world where you will find two mines next to each other. And yet we don't share infrastructure, we have two sets of tailings dams, two access roads. As a result, we're having a far greater impact on the planet than we absolutely need to have, and often the most precious resource sits in that wedge in the middle of the two mines.

And so now you've got an increasing number of people saying, isn't this mad? Help me combine our mines and run them as one? Save costs, minimize our footprint in the environment, and increase production? It's just happened in Chile, between two mines run by Anglo American and Codelco. You could do it across the Andes, you could do it in the South African platinum belt. So, I think it's going to open up a new way of collaboration and working together that the industry has not done before.

Q: So would you say minerals and mines, these are two sides of the same coin. So when you put both to work together you can achieve better outcomes, collaboration, innovation, technology. These are all key words and things that we need to think about.

Ro: Just one little thing to maybe leave you with. People know and understand that we need minerals. People don't want mining. And that is our challenge. So, metals and minerals are crucial. Everyone knows you can't do without them. But there's got to be a mine somewhere to supply those. And that's the part we haven’t got right yet.